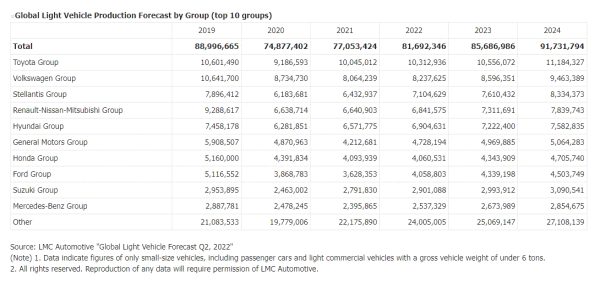

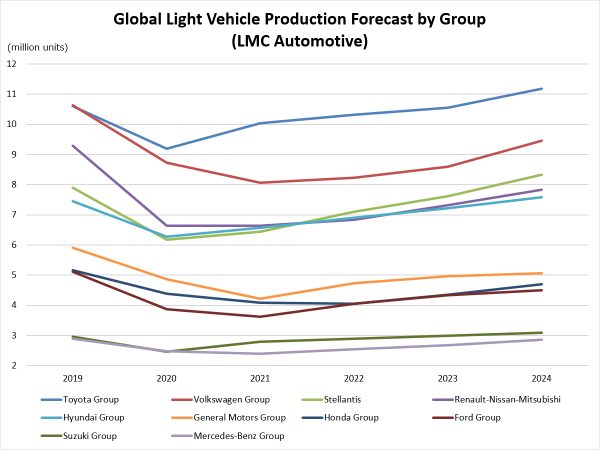

Global production in 2022 forecast to increase 6.0% to 81.69M units

Summary

According to a report by LMC Automotive as of Q2 2022, global light vehicle production in 2022 is projected to increase 6.0% YoY to 81.69 million units. The forecast has been revised downward by slightly less than 900,000 units from the previous forecast (as of Q1 2022)in light of the impact on the supply chain of the lockdown introduced in China in March, in addition to the prolonged supply shortage of materials, especially semiconductors.

-The forecast for global production in 2023 and 2024 is projected to steadily recover to 85.69 million units and 91.73 million units, respectively, although both forecasts have been revised downward by approximately 4.4 million units from the previous forecast.

-In the top group, European OEMs geographically and economically closer to Russia and Ukraine, such as VW, Stellantis, and Renault-Nissan-Mitsubishi, are expected to see their forecasts revised lower than that of No.1 Toyota, widening the gap.

-In the mid-tier group, No. 5 Hyundai’s global production is projected to reach 7.58million units in 2024, exceeding the pre-COVID-19(2019)level. On the other hand, No.6 General Motors is projected to produce just over 5 million units in 2024, well below the actual 2019 level of just under 6 million units.

Toyota Group

We assume chip and component shortages will continue. That, and the worsening economic conditions due to the war in Ukraine, will start to negatively impact global vehicle demand in the longer term. Although we now anticipate Toyota’s output should return to pre-pandemic levels in 2024, it could be delayed even further.

Volkswagen Group

WW Group’s global LV production is expected to have declined by 27.8% in H1 2022compared to 2019, due primarily to supply-side issues carrying over from last year, with those afflicting European and Chinese operations further intensified by Russia’s invasion of Ukraine and lockdowns in China, respectively. With these headwinds likely to persist, WW Group’s global build should remain below pre-pandemic levels inH22022, with declines in Q3(-18.2%) and Q4(-16.7%) versus 2019. Given the severe impact of war in Europe and the prolonged nature of increasing chip capacity, the 2019 build is not likely to be passed until 2026.

Stellantis

Stellantis’ global build is likely to have fallen by 18.3% in H1 2022 versus 2019, output continues to be tempered by supply shortages (especially of much-needed semiconductor chips)that have carried over from 2021. Demand-side disruptions are also present as price hikes in raw materials, energy, and transportation continue to inflate car prices and limit sales, especially for Non-Premium brands. That said, build is forecast to stabilize in Q3 2022(+1.4%) and Q4(+1.2%) versus 2019, with growth in emerging markets likely to support output.

Renault-Nissan-Mitsubishi

RNM’s global output declined by 34.2% in both Q1 and Q2 2022 versus 2019, a clue to supply disruptions carrying over from last year, which, in turn, have been exacerbated by the conflict in Ukraine from February and lockdowns in China from March. These headwinds, in conjunction with RNM’s global restructuring strategy to reduce its vehicle range by 20% by 2025 among other things, should continue to dampen production in H2 2022 with volumes likely to decline in Q3(-20%) and Q4(-16.4%). Hyundai Group

With crisis after crisis, the group will, inevitably, be hurt by them. So, we now anticipate a much milder rebound of 5.1% YoY in 2022.

GM Group

GM’s global production in Q1 2022 declined by 11.4%(-137k units), as the worldwide semiconductor shortage along with other production disruptions had a significant impact on the automaker’s ability to meet demand. For the full year 202, we see production increasing by 515k YoY(+12.2%), mainly on improved parts supply.

Honda Group

We now assume the OEM’s global 2022 production will drop slightly, by 0.82%.to4.06 mn units. There is little sign of significant recovery from all the issues brought about by chip and component shortages and the war in Ukraine. Thus, we have downgraded our forecast and now do not anticipate the group’s production will return to pre-pandemic levels, at least not in our forecast horizon.

Ford Group

Ford faced greater losses from the chip shortage than many of its competitors in 2L021, in part due to its reliance on Renesas as a chip supplier- its operation in Japan caught fire and was out of operation for several months during the year. In 2022, however, Ford seems poised to begin its recovery, with volumes projected to rise by 11.9% YoY (+430k units).

Suzuki Group

Suzuki is forecast to produce 2.9 mn units globally in 2022, up 4% YoY, compared to our outlook of 2.78 mn units(-1% YoY) in the previous report. The group’s growth is driven by strong demand in the Indian market, with output calculated to climb by 8% YoY to 1.80 mn units this year at its biggest global base.

Mercedes-Benz Group

Mercedes-Benz’s global build looks like having fallen by 3.3% YoY in Q2 2022((and -17.7% versus 2019), which, in turn, should contribute to a contraction of 15.1% compared to 2019 over the first half of the year. Persistent supply issues, carried over from last year and intensified by the Russia-Ukraine war and COVID-19 lockdowns in China, are likely to be the primary cause of this decline. Indeed, the (group’s production in H1 2022 is expected to have dropped in Europe(-27.4%) and China(-11.2%)when compared to 2019. Given these headwinds, global build volumes are anticipated to remain below pre-pandemic volumes in Q3(-22%) before rebounding in Q4(+4.5%), with the main boost coming from production expansion in China.